Liabilities

A D V E R T I S E M E N T

Liabilities are essentially debts. They can be:

current (short term): due & payable within 1 year

long-term: due & payable in over 1 year

The most common liabilities are:

Accounts Payable: for routine expenses and inventory purchased

on credit

Notes Payable: short- or long-term loans from banks or other

lenders

Accrued Expenses: various current expenses, accrued to

prepare financial statements; these can include accounts such as interest

payable, taxes payable, wages payable, and other similar accruals at the end of

the year.

Mortgage Notes: long term borrowing to purchase major assets;

the assets purchased are also pledged as collateral

Bonds Payable: corporation general debt; bonds of major

corporations can be purchased on a public stock exchange; bonds pay interest on

a regular basis, usually twice a year; bonds may have maturity dates from 5 to

30 years, or any other time frame selected by the company and acceptable by

lenders.

Liabilities often have to be estimated at balance sheet date,

so we can prepare financial statements.

Amortization table

An amortization table is a calculation involving interest and

regular payments, or reductions, in an account or debt. Costs can be amortized

over several years, using an amortization table. They are usually prepared to

show the progress of loan payments, especially in long-term mortgage loans. If

you have a home loan, you will probably get an amortization table from your

bank, showing how your payments are divided among interest, principle and other

fees (escrow).

Amortization tables are relatively easy to prepare. The use

of computer spreadsheet programs makes creating these tables a very simple task.

One "template" can be created and used over and over for different amounts,

interest rates and time frames.

Interest calculation

Interest applies to many liabilities. Notes, bonds and mortgages

all involve interest.

Interest is the fee you pay for the use of someone else's

money. The calculation is always the same.

| IInterest

= Principle X

Annual Interest Rate

X Time (portion of

a year) |

Interest Rates are always expressed in annual terms. For

instance, 12% interest means 12% per year, or 1% (1/12) per month.

The Time factor is always in relation to a year, so it

maintains the correct relationship with annual interest rates. One month's time

factor would be 1/12. Three months' would be 3/12, 7 months would be 7/12, etc.

Sometimes interest agreements are expressed in a number of

days. We usually use a 360 day year to make the calculation easier, and more

rounded. This goes back to the days before modern calculators and computers,

when we used pencil and paper to calculate interest. Example: 30 day note uses

30/360 time factor.

Using Amortization Tables

Amortization is an accounting method used to spread costs or

payments over a period of time, based on a few basic concepts: Time, Principal

(money or cost), and Interest Rate. Amortizing a loan balance uses all three of

these to reduce a loan balance to zero over a number of years. This might apply

to a home mortgage or automobile loan. It might also apply to an automobile or

equipment lease.

Interest is always expressed as an annual Rate, so your

interest calculation must always have a Time factor. For instance, one year's

interest on $100 at 12% (annual rate) is

$100 x 12% = $12 annual interest [on your calculator 100 *

.12 = 12]

If you make a home or car loan payment every month, you would

not want to pay a year's worth of interest on each monthy payment, would you?

(this is not a trick question ;-) Of course, you would only want to pay one

month's interest each month. So we have to add a Time factor to the annual

interest calculation above. In this case there are 12 months in a year, to

calculate one month's interest we would use 1/12 as a Time factor.

$100 x 12% x 1/12 = $1 monthly interest [100 * .12 / 12 * 1=

1]

If you wanted to calculate interest for 2 months you would

use 2/12:

$100 x 12% x 2/12 = $2 interest [100 * .12 / 12 * 2 = 2]

The monthly payment amount stays the same each month, and is

divided between interest expense and principal reduction. As the principal goes

down, so does the interest expense. Eventually the principal amount is zero,

perhaps over 5 years for a car loan, or 25 years for a home mortgage.

Let's say you buy a new home with a $100,000 mortgage, spread

over 25 years, at 8% interest. How much is your payment going to be, and how

much interest will you pay over the life of the loan if you make all the

payments on time? Here's a good website you can visit to answer this type of

question.

http://www.interest.com/calculators

I used their calculator to answer this question, and create

an amortization table. It took about 10 seconds. Your monthly payment would be

$771.82 and your total interest over the life of the loan (25 years) would be

$131,542.40. In total your $100,000 loan would cost you $231, 542.40 -- that's

over twice the amount of money you originally borrowed, in fact you would pay

back 2.3 times your original loan amount.

Many borrowers reduce their overall interest expense by

making extra principal payments on their loans whenever possible. Look at an

amortization table you will see that most of the monthly payment goes to

Interest and only a small portion goes to Principal Reduction. [If you have not

done so yet, use the calculator link, and enter the amounts shown above, then

generate an amortization table and look at it.]

At the end of month 1, you would have paid $771.82 ($666.67

interest and $105.15 principal). This reduces your principal balance to

$99,894.85. If you were to make all the first 12 payments on time you would have

paid $9,261.84 ($7952.69 interest and $1309.15 principal.) At the end of 12

months the loan balance would be $98,690.85. Now, follow closely at this point.

| Principal balance after month 1 |

$99,894.85

|

| Principal balance after month 12 |

$98,690.85

|

| Difference |

$1,204.00

|

| Month 1 payment |

$771.82

|

| Total payment |

$1975.82

|

If I pay and extra $1204 principal in month 1, it will reduce

my principal balance and move me down the amortization table to where I would be

after 12 months. I would avoid paying the amortized interest for months 2 - 12,

a savings of $7286.02 over the life of the loan.

In other words, paying an extra $1204 principal saved me

$7286 in interest. It would also reduce my total loan payments by 1 year,

because I moved down 12 months on the amortization table.

An alternative: Let's say you can't afford to pay that much

extra principal each month. If you move down the amortization table one extra

month, and pay just that amount of extra principal, you would cut your total

interest (about) in half, and cut the loan payoff time in half. In this example

you would reduce the loan from 25 years to 12.5 years, and reduce your total

interest from $131,542.40 to (about) $65,771.20 - a huge savings!!

CAVEAT: You must still make monthly loan payments, even if

you pay off some principal early. So you should incorporate extra principal

reduction strategies into your overall cashflow budget. But the earlier you

reduce your principal, the better.

Using a spreadsheet, you can quickly create an amortization

table for any principal amount, interest rate, payment amount or time factor.

With a spreadsheet you can quickly see how different interest rates and payment

schedules can effect your personal finances. You can use it for credit cards as

well. The same concepts apply.

Preparing and using an Amortization Table, year-end balances and adjusting

journal entries

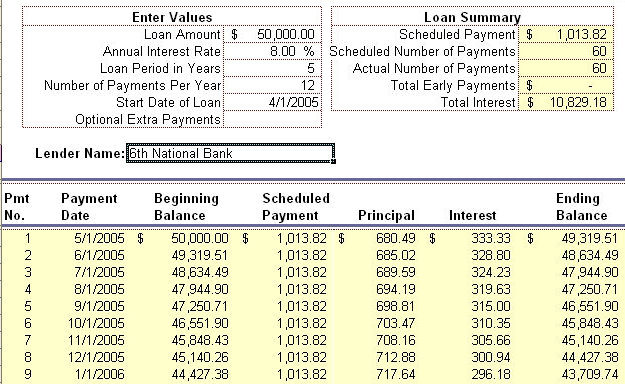

On April 1, 2005, Mike's Bikes, Inc. signed a 5-year, $50,000 note payable to

6th National Bank in conjunction with the purchase of equipment. The note calls

for interest at an annual rate of 8%, with payments of $ 1,013.82 per month

starting May 1, 2005. The note is fully amortizing over a period of 60 months.

The bank sent Mike an amortization table showing the allocation of monthly

payments between interest and principal over the life of the loan. A small part

of this amortization table is illustrated below.

In Chapter 7 we prepared a Bank Reconciliation to dertermine the correct Cash

account balance. We also entered journal entries to correct any errors and

journalize any unrecorded transactions.

In Chapter 10 we are going to verify the correct account balances for Notes

Payable and Interest Payable, that is, the balance these accounts should be

as of year-end on December 31. This is one of our standard and ordinary year-end

procedures.

We determine correct loan and interest payable balances by creating an

amortization table. We will write adjusting entries to bring the account

balances into agreement with the amortization table.

Let's look at some journal entries over the life of a loan and see how

they relate to the amortization table.

Journal entry to record the original note payable of $50,000 on April

1, 2005. We have increased Cash (Debit) and increased Notes Payable (Credit). No

interest has accrued yet. Interest is related to time, so at least one day must

pass before we can calculate (accrue) interest.

| Date |

Account |

Debit |

Credit |

| Apr-1 |

Cash |

$50,000 |

|

| |

Notes Payable |

|

$50,000 |

| |

To record 8% 60-month note with

6th National Bank |

|

|

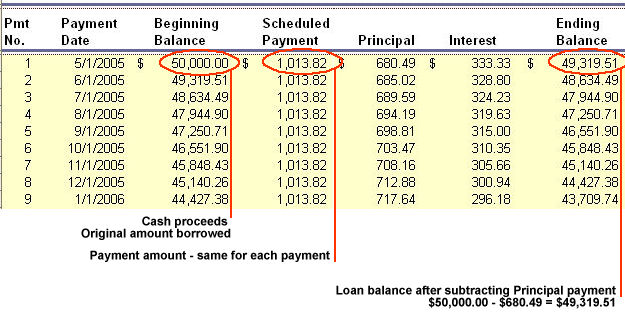

Monthly payments and principal balances

Interest calculation

Beginning Balance * Annual Interest Rate * Time Factor

$50,000 * 8% * 1/12 = $333.33

Principal payment = Payment amount - Interest

$1,013.82 - $333.33 = $680.49

Principal balance reduction

Beginning Balance - Principal payment = Ending Balance

$50,000 - $680.49 = $49,319.51

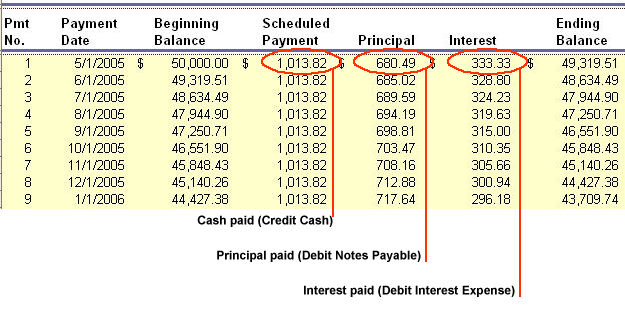

Journal entry to record the first monthly payment on this note, May 1,

2005, payment 1 from the amortization table above.

| Date |

Account |

Debit |

Credit |

| May-1 |

Notes Payable |

$680.49 |

|

| |

Interest Expense |

333.33 |

|

| |

Cash |

|

$1013.82 |

| |

To record monthly note payment for May. |

|

|

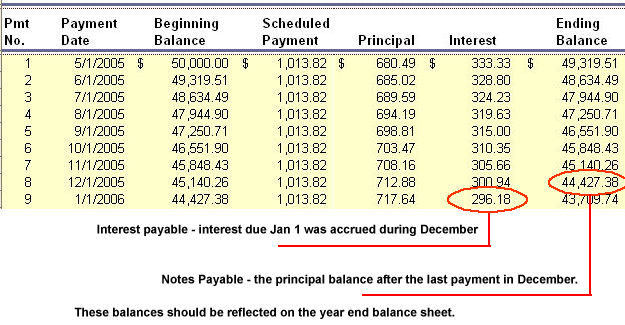

Balances at December 31, 2006 (year end)

Making Year-End Adjusting Journal Entries

Adjusting journal entries should be made to bring account balances to the

correct amount before preparing financial statements. The Books are not always

correct or accurate. This situation needs to be corrected at the end of the

year, or anytime we need to prepare Financial Statements

At the end of each year we organize our adjusting entries on a Working Trial

Balance (WTB) before preparing financial statements. You can see an example of

the WTB in Comprehensive Problem 1, in your text. Let's look at an example of

year-end adjusting entries.

Example - adjusting Notes Payable at year-end

Assume the following: We look at the WTB and see that the loan balance is

recorded as a credit balance of $ 44,329.16. We compare this with our

amortization table and see that the correct balance should be a credit balance

of $ 44,427.38. We need to make an adjusting entry to bring the books to the

correct balance.

In this case we need to credit Notes Payable for $ 98.22 to bring the

books into agreement with the amortization table. In some cases we would have to

debit Notes Payable. When do you think that would be the case? If an

amortization table was used for each monthly loan payment, the books should

agree with the amortization table, and no adjusting entry would be needed in

that case.

What account should we debit? We must review the related journal entries for

the year and see which accounts were debited and credited each month. In most

cases we will make the adjustment to the Interest Expense account (look at the

monthly entries above). In some cases we may find that a different account was

used by mistake. We would correct that error as well, when making the year end

adjustments. Let's assume that the only two accounts effected in this example

are Notes Payable and Interest Expense. The adjusting journal entry would be.

| Date |

Account |

Debit |

Credit |

| Dec-31 |

Interest Expense |

$ 98.22 |

|

| |

Notes Payable |

|

$ 98.22 |

| |

To adjust Notes Payable to agree with amortization table |

|

|

Proof:

| |

Debit

|

Credit

|

| Notes Payable balance |

|

44,329.16

|

| Adjustment |

|

98.22

|

| Corrected NP balance |

|

44,427.38

|

| Balance per amortization table |

|

44,427.38

|

| Difference |

|

0

|

The same approach can be used to reconcile and adjust Interest Expense. But

generally speaking we are more concerned with having the correct Notes Payable

balance on the balance sheet.

Large businesses record transactions daily, sometimes in Real Time, as they

happen. Smaller businesses may record transactions less frequently, perhaps at

the end of the day, week or month. Bookkeepers often have to make estimates,

especially when they don't have enough information to write a correct entry.

This is common in the business world.

Here's a common example, and one I see on a regular basis as an accountant

and tax preparer. A client or their bookkeeper records a loan payment as a debit

to "Loan Payment" and a credit to "Cash." You should know by now that

accountants don't use an account called "Loan Payment." We record a loan payment

with debits to Interest Expense and Notes Payable and a credit to Cash, as shown

in the examples above. To correct the bookkeeper's error we would write an

adjusting entry to debit the correct accounts and bring the "bogus" account to a

zero balance.

Present Value

If you owe me $1000 I would like to have it paid as soon as

possible. I am losing the use of my money as long as you owe me.

If I fall on hard times I might prefer to get my money paid

back sooner, rather than later, because I need the money now. I might be

inclined to settle for less than the full amount of the debt, in order to get

the cash I need as soon as possible.

Let's say I could earn 10% interest if I had the money you

owe me. In one year I would lose:

$1000 x 10% x 1 = $100 interest

if you paid me back now I could accept

$1000 - $100 = $900

Investing that money in an interest bearing account, which

compounds daily (typical bank method), the $900 would grow to $1000 in a year. I

would be in the same position at the end of a year, either way. But one way I

have my money available in case I need it, which may be preferable.

The long and short of this story is simple. Money has a

value, over time. It can be calculated fairly easily. If we don't have our

money, we lose the use of it. Having money now is better than having it in the

future, because I can put it to better use if it is available to me.

The business world accepts these simple facts about money,

and business managers assume that interest should be earned or paid whenever

appropriate in the situation. Federal tax law mandates that interest be charged

where appropriate. Zero interest loans are not recognized for federal tax

purposes.

Contingencies

A contingent situation is one that may arise in the future,

based on some past event. For instance, if I sell lawnmowers one of them might

break in the warranty period, and I will have to replace it. The warranty claim

will arise in the future, from a sale made today.

There may be contingent gains or losses. Contingent gains are

ignored until they are finalized. Contingent losses are recognized as soon as

they can be identified and measured.

GAAP places a couple of requirements on contingent losses.

They should be reported in the financial statements if they meet BOTH of two

criteria:

1) the loss is probable,

2) the amount can be reasonably estimated.

It must also be a material amount, in order to have a

reportable effect on the financial statements. Some are just a normal part of

business, called general business risk, and are not reported. For instance, we

all know that airplanes can crash. Airlines don't consider this a reportable

contingency, because it is impossible to predict the occurrence or amount of

loss in advance.

On the other hand, the company may be involved in a lawsuit.

Their attorney advises them that they will probably lose, based on other cases

and the probable loss will be $100,000. The loss is probable, and the amount can

be reasonably estimated. The loss would be entered into the books, with a

journal entry, and disclosed in the financial statements.

|